How do I value shares for probate?

When valuing anything for probate, it’s all about the value on the date of death. In this post we’ll take you through, step-by-step, how to value shares on the stock exchange. To do this, we’ll need the highest and lowest prices on the date of death. After that, there is a simple calculation to do which we describe below.

We’ll use the example of 500 shares in BT (British Telecom) for someone that died on the 24th of June 2022.

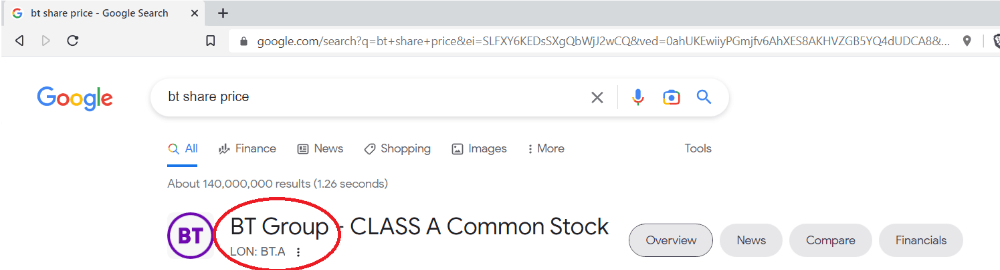

Step 1: Find out the company name on the stock exchange

Type the name of the company into Google with the words ‘share price’ after it. This should bring up its share profile where you can find their legal name. For BT, you can see they are listed as ‘BT Group’.

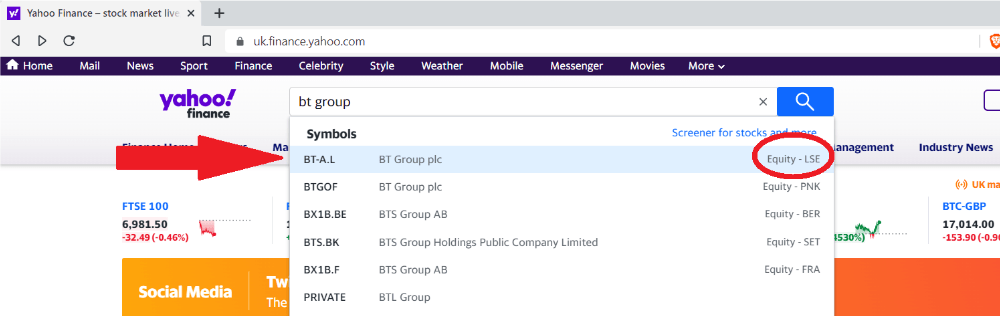

Step 2: Go to the Yahoo Finance website and find the company

Type the name into the search box of the Yahoo Finance website and select the correct option.

You’ll notice on the right hand side it says ‘LSE’ - this is the ‘London Stock Exchange’. Some companies are listed on multiple stock exchanges, so it’s important to get the right one. If you’re unsure which stock exchange to use, it should say it on the share certificates you have.

Alternatively, contact the company that manages the registration of the company’s shares. There are 3 main companies that do this: Equiniti, Computershare, and Link Asset Services.

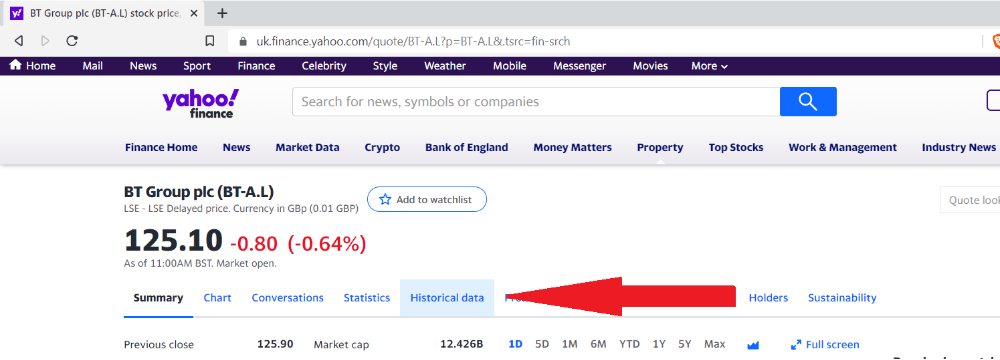

Step 3: Select ‘Historical data’

After clicking on the correct company in the search results above, you’ll land on the company’s share price page. Click on ‘Historical data’ - you may have to scroll down a bit to see this.

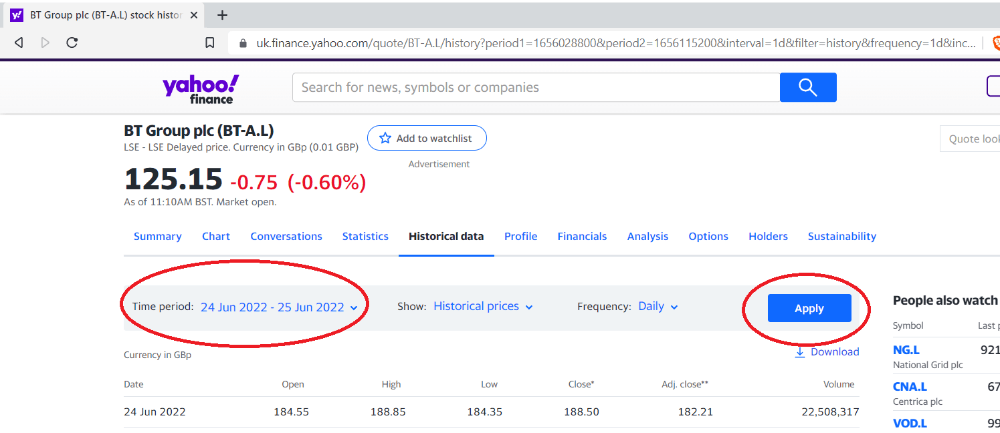

Step 4: Select the right time period

Use the date selector to select the date of death and the following day (make sure you have the correct year as it will usually be set a year earlier by default).

If the date of death was on the weekend, select the Friday and Monday on either side - you may use the lower of the two days’ price in your calculations below. Click the blue ‘Apply’ button when you’ve selected the correct dates.

Step 5: Calculate the share price to use in your inventory

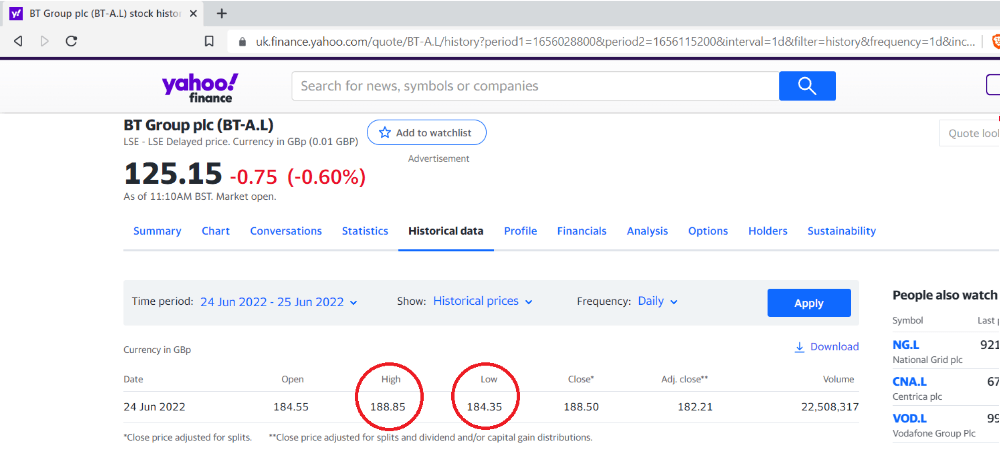

To calculate the share price to use in your inventory, you need to work out what’s known as the ‘quarter-up’ price. This is the lower price, plus one quarter of the difference between the higher and lower prices.

In our example, to calculate the quarter-up price, you would:

- Find the difference between the higher price and the lower price, 188.85p - 184.35p = 4.5p.

- Work out a quarter of this difference, 4.5p × 0.25 = 1.125p.

- Add this to the lower price, 184.35p + 1.125p = 185.475p.

So, the quarter-up price is 185.475p. This should be rounded to 185.48p.

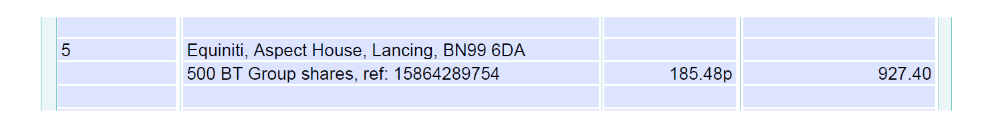

Step 6: Calculate the value of the shareholding and add it to your inventory

To calculate the value of the shares, we multiply the number of shares by the share price. 500 x 185.48p = 92740p. The answer is in pence so we convert it to pounds by dividing by 100 to get £927.40.

When entering shareholdings into the inventory page of your C1, it’s best to list them under the company that manages the registration of the shares as it is to them that you need to show the probate/confirmation document to. There are 3 main companies that do this: Equiniti, Computershare, and Link Asset Services.

Further help with the C1 form

Filling in the C1 form can be a fiddly business. This is made worse because the official guidance from the Sheriff Courts and HMRC is ambiguous and incomplete. The Sheriff Courts are also incredibly strict about the wording and layout of the forms (standards that they don’t share with the public).

We can help you complete the forms with our Probate Support Service, which includes:

- a step-by-step guide written in plain English

- copies of C1 forms that were successful

- a manual checking service to make sure you get everything 100% right

- template covering letter for the court that doubles as a checklist

- unlimited email support